Hello, today I will try to explain to you visually step by step how to establish a sole proprietorship. Contrary to popular belief, it is very easy to establish a sole proprietorship right now. If you want to establish the company yourself step by step, I will write to you what you need to do and what you should pay attention to. But before that, I recommend that you read my article about

the conditions of establishing a sole proprietorship

and have basic information. Sole proprietorship establishment.

First of all, you can open the company establishment page with two methods. 1.si When you log in to the e-government and type “Establishment of Obligation (Request for Notification of Commencement of Work) by the E-Government Tax Offices for Real Persons in the search section, you can go to the application. 2.si you can access the following page by logging into the interactive tax office with your e-government password and typing start work in the search section above. As I mentioned in my other article, you must have made the choice of rental information, activity code and real procedure-simple procedure. From this point on, when you open the page, you will see this screen. You should record your address step by step by writing the city, district, street and door number information from the section that requests your address information from you. Then you must add and save your 6-digit activity code from the add activity section. At this stage, it will be clear where your tax office directorate is located below. When you say next, you will move on to the 2nd part.

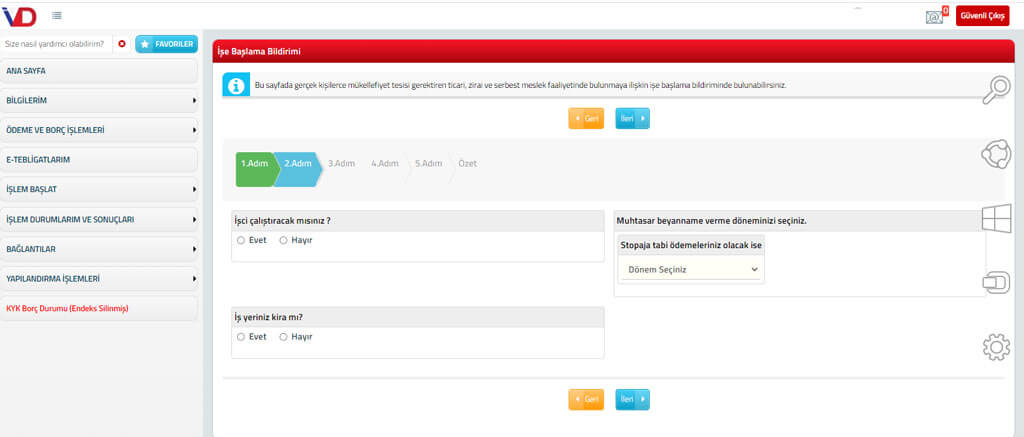

In part 2, you will see such a page.

Here, you are asked whether you will employ workers as soon as you open the workplace and rent information. You have to give the yes and no signs. If the workplace does not belong to you, the owner will ask you for your owner information, your owner’s TR ID number, whether the payment will be annual or monthly, and how much net gross payment will be made. After writing these, when you say next, you will move on to the 3rd part.

In section 3, you will be asked about the procedure to which you will be subject. Although this is a detailed topic, I have explained the details required in the content of

my article about the conditions of establishing a sole proprietorship

so that you have information. However, if you are still in a dilemma about this, you can consult me free of charge by contacting me from the contact information. When you say next after making the selection 4. You will move on to the section.

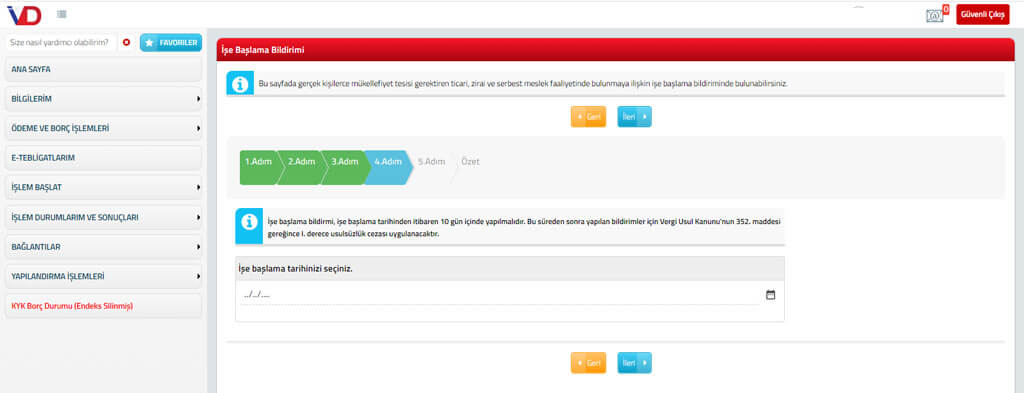

In this section, you will be asked about your start date. Your start date must coincide with the start date of the lease and you must not exceed the 10-day period. For example, the date of your lease contract, which indicates that you will start work, is 01.12.2022, but if you notify you of the start of work on 20.12.2022, you will miss the 10-day period and you will receive a 1st degree special irregularity penalty. When you mark the date you started work and click next, you will see page 5.

In section 5, there is information about the activation of your electronic notification. Now, when the tax office notifies you, it can send its notifications to your interactive tax office electronically within the scope of the law. It is mandatory to be included in this system. You should check the text message and e-mail boxes and write the mobile phone and e-mail addresses you definitely use below the question of whether you want to be included here. At the bottom, after filling in all the information, when you mark the warning “I have read it, I accept it” and say next, a code will be sent to your phone through the Revenue Administration. When you enter this code and confirm it, you have notified your opening. After that, you will need to work with a financial advisor to file your returns.

As Ahmet Faruk Altınş Financial Consultancy Office , we can help you with important issues that you are curious about, want to learn, and that will guide your business. You can contact us using the information on our contact page for more details and to take advantage of our free preliminary consultancy service.